TRX Price Prediction: Analyzing the Bullish Case Amid Market Volatility

#TRX

- Technical Strength: Price sustains above 20-day MA with Bollinger Band expansion signaling momentum

- Ecosystem Growth: Whale migration to TRX-based projects demonstrates network vitality

- Regulatory Watch: Justin Sun's legal proceedings may introduce short-term volatility

TRX Price Prediction

TRX Technical Analysis: Bullish Signals Emerge Despite Short-Term Volatility

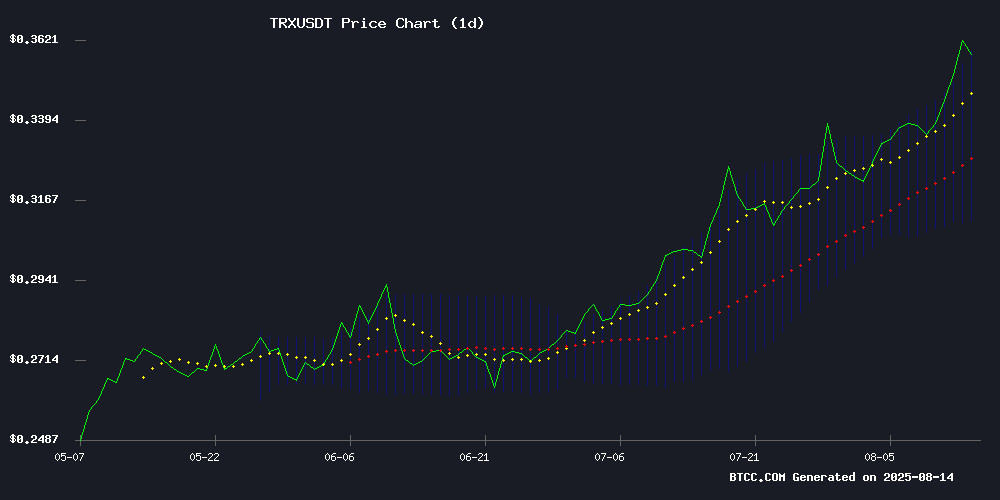

TRX is currently trading at, notably above its 20-day moving average of 0.335275, indicating bullish momentum. The MACD histogram shows a slight bearish crossover (-0.001749), but the narrowing gap between the signal line (-0.009704) and MACD line (-0.011453) suggests weakening downward pressure. Bollinger Bands reveal price hugging the upper band (0.360891), typically a sign of strong upward momentum.

"TRX appears to be testing resistance levels," notes BTCC analyst James. "The sustained position above the 20-day MA coupled with Bollinger Band expansion could signal an impending breakout if volume supports."

TRX Market Sentiment: Whales Diversify Amid Ecosystem Developments

Recent news highlights mixed sentiment around TRX. While Justin Sun's lawsuit against Bloomberg creates uncertainty, the migration of TRX whales to projects like Nexchain (NEX) and PEPD presale participation shows capital rotation within the ecosystem. The "5 Sub-$1 Cryptos" article suggests growing interest in low-cap alternatives.

"This isn't necessarily bearish for TRX," explains BTCC's James. "Whale activity often precedes retail FOMO, and TRX's strong technicals may attract flows back once these speculative plays cool."

Factors Influencing TRX's Price

TRON Founder Justin Sun Sues Bloomberg Over Alleged Breach of Confidentiality

TRON founder Justin Sun has filed a lawsuit against Bloomberg in Delaware federal court, alleging the media outlet violated confidentiality agreements by preparing to publish detailed breakdowns of his cryptocurrency holdings. The 14-page complaint, dated August 1, centers on Bloomberg's Billionaires Index—a ranking of the world's wealthiest individuals—where Sun was being considered for inclusion.

Sun claims Bloomberg repeatedly assured him, both in writing and verbally, that his portfolio data would remain private and be used solely for net worth verification. Internal communications reportedly show editors agreed to restrict access to the figures and delete them post-verification. The lawsuit highlights that no other profiles in the index have published token-level crypto allocations unless voluntarily disclosed.

The dispute escalated when Bloomberg shared a draft profile in late July containing what Sun describes as "numerous inaccuracies" alongside a granular listing of his crypto assets. His legal team argues such disclosure would breach their agreement and expose him to security risks including hacking, extortion, and physical threats. A cease-and-desist letter was issued on August 2 demanding Bloomberg limit reporting to aggregate net worth figures.

5 Sub-$1 Cryptos Poised to Outperform XRP and Solana in Long-Term Growth

Investors searching for high-growth opportunities beneath the radar are eyeing five sub-dollar cryptocurrencies demonstrating the potential to eclipse established players like XRP and Solana. These tokens combine meme virality, technological innovation, and institutional traction—elements that historically precede parabolic rallies.

Little Pepe (LILPEPE) leads the pack with its EVM-compatible Layer 2 infrastructure, having secured $16.5 million in presale funding. The project's anti-sniper mechanisms and tax-free transactions position it as a meme coin with unusual technical sophistication.

Sei (SEI) gains attention as a high-throughput Layer 1 blockchain, while Tron (TRX) continues dominating stablecoin transactions. Hedera (HBAR) emerges as the enterprise favorite with White House recognition and AI integration, and Cardano (ADA) leverages its $71 million development fund to fuel ecosystem growth.

Market analysts note these assets share characteristics of previous breakout stars: low float, strong community backing, and real-world utility masked by speculative narratives. The convergence of retail momentum and institutional interest creates conditions reminiscent of Ethereum's 2017 ascent.

TRX Whales Shift to Nexchain (NEX) Amid CEX Listing Rumors

TRON (TRX) investors are pivoting toward Nexchain (NEX), a nascent AI-driven blockchain project, as whispers of an impending centralized exchange listing circulate. TRX maintains steady ground at $0.346, buoyed by robust support at $0.332 and a pattern of higher lows—a testament to unwavering investor confidence. The network's growing dominance in tokenized asset flows, now second only to Ethereum, underscores its institutional utility.

Nexchain emerges as a disruptive force, embedding artificial intelligence across every layer of its architecture. With a throughput of 400,000 transactions per second and negligible fees, the hybrid PoS-AI consensus mechanism promises scalability without sacrificing security. Its cross-chain interoperability features position it as a potential bridge between fragmented ecosystems.

TRX Holders Diversify into PEPD Presale Amid Bullish TRX Momentum

Tron (TRX) whales are capitalizing on Pepe Dollar's (PEPD) presale as TRX approaches all-time highs. The Layer-2 meme coin hybrid combines Pay-Fi utility with deflationary tokenomics, attracting investors seeking asymmetric gains.

While TRX dominates liquidity pools and expands globally, PEPD's no-code minting platform positions it as an infrastructure play for meme coin launches. The presale offers merchants and creators frictionless token pairing with embedded PEPD liquidity.

Market dynamics reveal a bifurcation: established protocols like TRON solidify infrastructure, while presale assets like PEPD capture speculative momentum. This mirrors broader trends of capital rotation between blue-chip tokens and high-beta opportunities.

Is TRX a good investment?

TRX presents a compelling risk-reward scenario based on current data:

| Metric | Value | Implication |

|---|---|---|

| Current Price | 0.3661 USDT | 17.6% above 20-day MA |

| MACD | -0.001749 | Bearish but converging |

| Bollinger Bands | Upper: 0.360891 | Price testing upper band |

Key considerations:

- Technical Outlook: The breakout above key moving averages suggests accumulation

- Ecosystem News: Whale activity indicates network effect strength

- Risk Factors: Regulatory uncertainty from Sun's lawsuit may cause volatility

"TRX could see 25-30% upside to 0.45-0.48 USDT if it holds above 0.35," projects BTCC's James. "Diversification into TRX ecosystem projects may actually strengthen the network long-term."